The insurance industry is evolving rapidly, and conversational AI is playing a pivotal role in this transformation. AI solutions are streamlining operations, reducing costs, and enhancing customer engagement. Teneo’s conversational AI, powered by large language models (LLMs) like OpenAI GPT-4o, Google Gemini and Amazon Bedrock, enables insurers to automate routine tasks, provide multilingual and multimodal support, and ensure over 99% accuracy in customer communications. This efficiency helps insurers stay competitive while ensuring compliance with industry regulations and maintaining top-tier data security.

5 Key Use Cases of Conversational AI Insurance

- 24/7 Customer Support

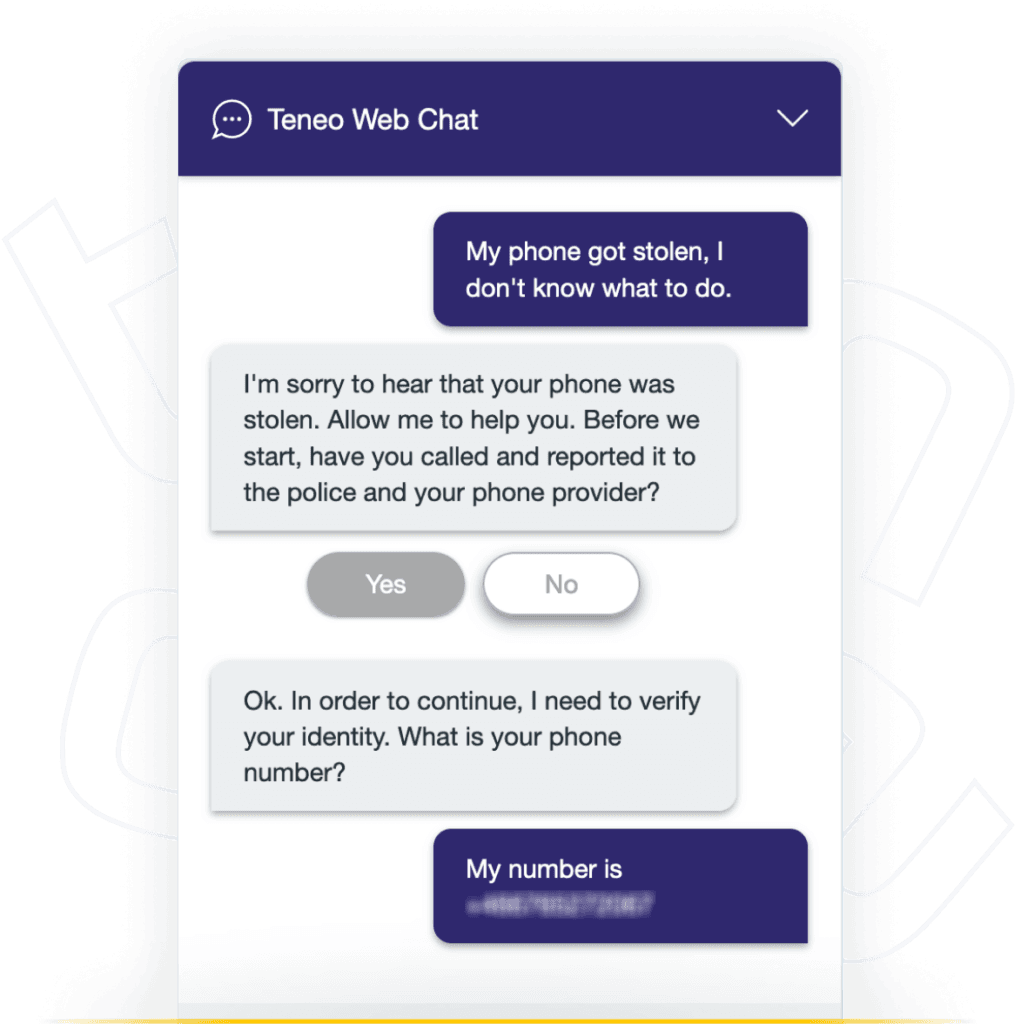

Conversational AI insurance provides round-the-clock support, offering immediate answers to customer queries, processing claims, and assisting with policy details without the need for human intervention. This leads to increased customer satisfaction and loyalty.

2. Automated Claims Processing

Filing insurance claims is often a cumbersome process, but conversational AI simplifies it by automating the collection and verification of data. With LLM orchestrator platforms like Teneo, virtual assistants guide customers through each step, reducing friction and expediting claims management, resulting in faster resolutions.

3. Fraud Detection and Prevention

AI-powered systems are capable of analyzing large amounts of data in real time. Conversational AI tools, like those provided by Teneo combined with Teneo Generative AI, can detect unusual patterns during customer interactions, flagging potentially fraudulent claims early and protecting insurers from significant financial losses.

4. Policy Customization and Personalization

With conversational AI, insurers can provide tailored policy recommendations based on customer behavior and preferences. Teneo’s solution offers personalized service with Teneo Adaptive Answers, helping customers understand and choose coverage that fits their unique needs, boosting engagement and retention.

5. Cost Reduction and Operational Efficiency

Teneo’s conversational AI allows insurance companies to reduce operational expenses by automating repetitive tasks. It frees up customer service agents to focus on more complex issues, driving greater efficiency. Insurers can have up to a 98% reduction in LLM costs with the FrugalGPT approach, highlighting the transformative potential of conversational AI.

Benefits of Conversational AI Insurance

- Multilingual Support: Insurers can provide consistent service across languages, ensuring a broader reach and improved customer satisfaction.

- Data Security and Compliance: Conversational AI solutions like Teneo offer robust data protection, ensuring adherence to industry regulations.

- Scalability: As customer demands grow, AI solutions allow insurers to easily scale without compromising on service quality.

The Future of Conversational AI Insurance

Conversational AI’s role in the insurance industry will continue to expand as technologies like Teneo evolve. Future advancements will likely include deeper integration with predictive analytics, enabling different industries to proactively offer solutions to customers based on data insights. Additionally, voice-activated systems will become more prevalent, allowing for even more seamless interactions.

Ready to transform your insurance services with conversational AI? Contact us to learn how Teneo’s AI-powered solutions can help your business streamline operations, enhance customer engagement, and reduce costs.

FAQs

How is conversational AI transforming the insurance industry in 2025?

Conversational AI is revolutionizing the insurance industry through multiple transformative applications: (1) Claims Processing Automation: AI-powered systems handle 100% of routine claims inquiries, reducing processing time from days to hours while improving accuracy, (2) Policy Management: Automated policy inquiries, renewals, and modifications with 24/7 availability and instant response times, (3) Customer Onboarding: Streamlined application processes with intelligent form completion and document verification, reducing onboarding time by 60-70%, (4) Risk Assessment: AI-driven analysis of customer data for personalized policy recommendations and pricing optimization, (5) Fraud Detection: Advanced pattern recognition identifying suspicious claims with 99%+ accuracy, (6) Multilingual Support: Global customer service capabilities in most languages for international insurance operations. The industry reports 40-60% improvement in customer satisfaction and 50-70% reduction in operational costs.

Explore insurance-specific AI solutions tailored for regulatory compliance and industry requirements.

What specific benefits does conversational AI provide to insurance companies and their customers?

Conversational AI delivers significant benefits to both insurance companies and customers: For Insurance Companies: (1) Operational Efficiency: 60-80%

reduction in call center costs through automation of routine inquiries and claims processing, (2) Improved Accuracy: 99%+ accuracy in information delivery and claims handling, reducing errors and compliance risks, (3) Scalability: Handle peak periods and seasonal fluctuations without additional staffing costs, (4) Data Analytics: Comprehensive customer interaction insights for product development and risk assessment, (5) Regulatory Compliance: Built-in compliance features for industry regulations and audit requirements. For Customers: (1) 24/7 Availability: Instant access to policy information, claims status, and support services, (2) Faster Claims Processing: Reduced wait times from days to hours for routine claims, (3) Personalized Service: Tailored policy recommendations and coverage options based on individual needs, (4) Consistent Experience: Standardized service quality across all interaction channels. Customer satisfaction typically improves by 35-50% with AI implementation.

Request an insurance industry demo to see specialized conversational AI capabilities.

What challenges do insurance companies face when implementing conversational AI, and how can they overcome them?

Insurance companies encounter several key challenges during conversational AI implementation: (1) Regulatory Compliance: Meeting strict industry regulations requires AI systems with built-in compliance features, audit trails, and data protection capabilities, (2) Data Security: Handling sensitive customer information demands enterprise-grade security with encryption, access controls, and privacy protection, (3) Complex Product Knowledge: Insurance products require sophisticated AI training on policy details, coverage options, and regulatory requirements, (4) Integration Complexity: Connecting AI systems with legacy insurance platforms, claims management systems, and regulatory databases, (5) Customer Trust: Building confidence in AI-powered insurance services through transparent communication and reliable performance. Solutions: (1) Choose enterprise-grade platforms with insurance industry experience and compliance certifications, (2) Implement phased rollouts starting with simple use cases, (3) Invest in comprehensive training data and domain expertise, (4) Partner with experienced AI vendors providing implementation support and ongoing optimization. Successful implementations achieve 90%+ customer acceptance rates within 6 months.

Download our contact center automation guide for proven strategies and best practices.