Debt collection has always been a balancing act between recovery performance, regulatory compliance, and customer experience. Today, that balance is harder than ever. Rising delinquency volumes, fragmented contact center environments, and increasing regulatory scrutiny are exposing the limits of traditional automation and human-only operating models.

For enterprise collections leaders, the question is no longer whether to use AI in debt collection, but what kind of AI can operate safely, consistently, and at scale in a regulated environment. The answer is not generic chatbots or CCaaS-native bots. It is enterprise-grade, agentic AI designed specifically for collections.

Why traditional automation fails in debt collection

Most legacy collections automation was built for efficiency, not governance. IVRs handle basic balance checks, while scripts and rules engines attempt to enforce compliance. When conversations deviate—as they inevitably do—calls escalate to human agents, increasing cost and risk.

This approach breaks down for three reasons:

- Collections conversations are non-linear. Customers ask questions, dispute balances, request hardship support, or negotiate payment plans. Static flows cannot adapt safely.

- Regulatory obligations are contextual. Disclosures, consent, and vulnerability handling depend on jurisdiction, call stage, and customer signals.

- Enterprise environments are fragmented. Multiple BPOs, CCaaS platforms, and legacy systems create inconsistent customer experiences and governance gaps.

AI debt collection requires more than conversational capability. It requires control, orchestration, and auditability.

What makes AI debt collection different at enterprise scale

Enterprise-grade AI debt collection systems are designed around outcomes, not just interactions. They combine probabilistic logic from GenAI models like Google Gemini 3 and OpenAI GPT 5.2 with deterministic logic to ensure every conversation adheres to policy and regulation.

This is where Agentic AI changes the model.

Agentic AI does not simply respond to customer input. It executes defined objectives—such as verification, payment plan setup, or settlement negotiation—within strict guardrails. The AI agent knows what it is allowed to do, what it must disclose, and when it must stop or escalate.

For regulated collections, this distinction matters.

From scripted flows to governed autonomy

In an agentic model, the AI agent can:

- Authenticate customers and deliver mandatory disclosures in the correct sequence

- Negotiate payment plans within pre-approved thresholds

- Capture binding promises to pay (PTP) and schedule follow-ups

- Detect hardship or vulnerability signals and route appropriately

- Process payments securely without exposing sensitive data

Crucially, it does this without hallucination and without deviation from policy, because the conversational layer is constrained by deterministic decision logic. Something that is possible with Teneo Hybrid AI.

The operating model shift: AI as the first-line collections agent

High-performing enterprises are redefining the role of AI in debt collection. Instead of treating AI as a deflection tool, they deploy it as the primary collections agent for high-volume, high-risk journeys.

This shift delivers measurable impact across core KPIs:

- Call containment increases as AI resolves full end-to-end journeys, not just entry points

- First call resolution improves through immediate negotiation and payment execution

- Cost per call drops dramatically by reducing reliance on human agents for routine and mid-complexity cases

- Compliance risk decreases through consistent disclosures, full transcription, and auditable decisioning

Human agents are not removed from the process. They are reserved for complex disputes, legal escalations, and emotionally sensitive cases where empathy and judgment are critical.

Governance and compliance: The non-negotiables of AI debt collection

AI debt collection fails when governance is treated as an afterthought. For enterprise risk and compliance leaders, three capabilities are essential.

Deterministic control over AI behavior

LLMs alone are not suitable for collections. They must be constrained by a logic layer that enforces:

- Approved scripts and disclosures

- Jurisdiction-specific rules

- Eligibility thresholds for settlements and discounts

- Escalation and termination conditions

This ensures zero improvisation in regulated moments.

Full auditability and traceability

Every AI-led collections interaction must be:

- Fully transcribed and summarized

- Attributed to specific policies and decisions

- Available for audit, dispute resolution, and regulator review

This is particularly critical in multi-BPO environments where consistency is otherwise difficult to prove.

Secure handling of sensitive data

Payment processing, identity verification, and hardship indicators require strict adherence to PCI-DSS, GDPR, and local privacy regulations. Enterprise AI platforms must isolate sensitive data and avoid exposing it to underlying models. For more info, see Teneo Security Center.

Why pre-built collections agents accelerate time-to-value

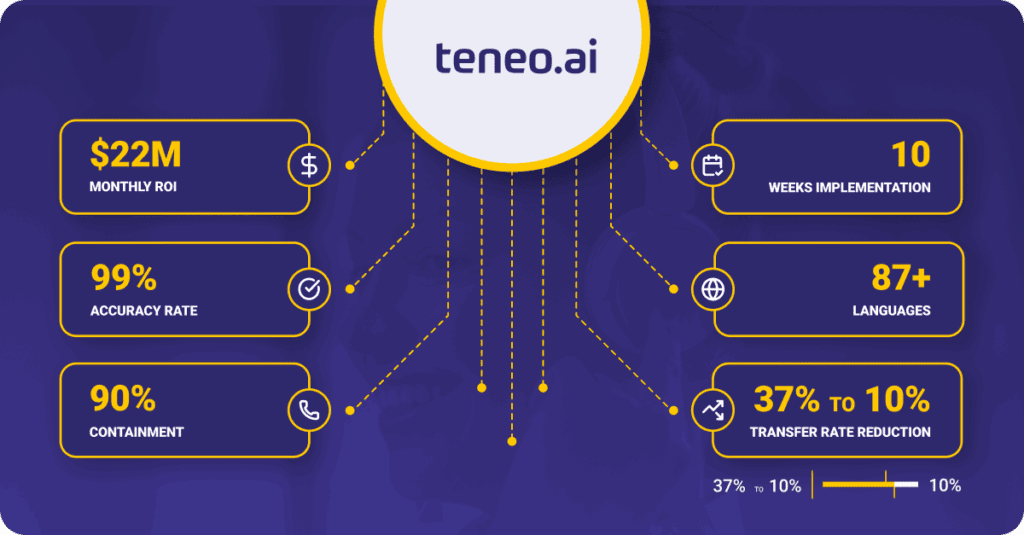

Building AI debt collection from scratch is risky and slow. Pre-built collections agents, designed specifically for recovery use cases, allow enterprises to deploy in weeks rather than months.

These agents come with:

- Proven collections workflows across the full lifecycle

- Embedded compliance logic for regulated markets

- Pre-configured integration patterns for CCaaS, CRMs, and payment systems

- Support for multilingual and regional language variations

For enterprises operating across regions and vendors, this approach centralizes intelligence while allowing local policy control.

The strategic advantage: Consistency across a fragmented ecosystem

One of the most underestimated benefits of AI debt collection is experience consistency. Customers do not care which BPO or platform they reach. They expect the same answers, tone, and options every time.

Enterprise AI orchestration enables:

- A single collections brain across multiple contact centers

- Consistent negotiation logic and settlement policies

- Centralized updates to compliance rules without redeploying scripts

This consistency protects brand reputation while improving recovery performance.

Ready to modernize debt collection without increasing risk?

Teneo helps global enterprises deploy governed, agentic AI for debt collection—designed for compliance, control, and measurable recovery outcomes.